Unlock your financial potential with

Gao Yin Financial Corporation

To meet your needs

Financial planning

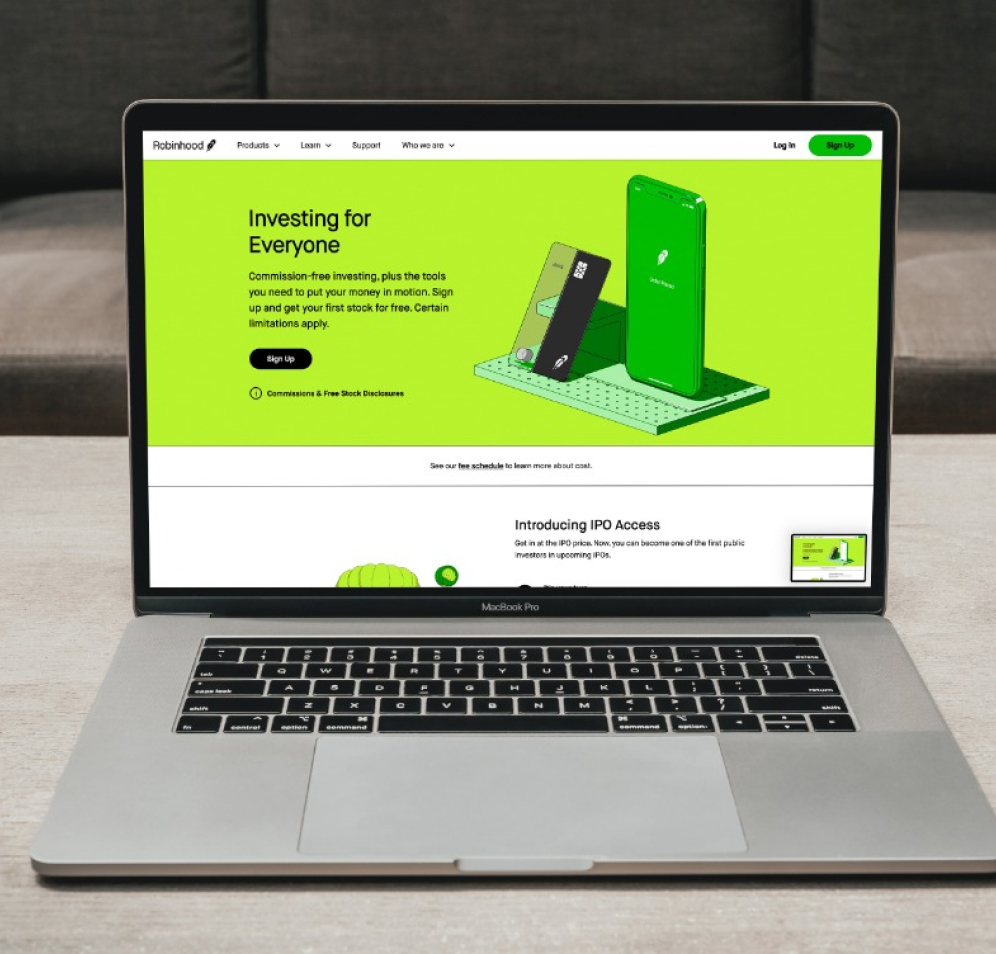

Initial Public Offerings (IPO):

As experts in IPO advisory, we assist companies in successfully navigating the process of going public. From strategic planning and due diligence to regulatory compliance and investor communications, we provide end-to-end support to ensure a eamless and successful IPO.

Funding Solutions

We offer tailored funding solutions to meet the unique needs of our clients at various stages of growth. Whether it's seed funding, early-stage investments, or series A to C funding rounds, our seasoned team leverages our extensive network of investors and venture capitalists to secure the right funding partners for our clients.

Fintech Investments

As avid supporters of innovation in the fintech sector, we actively invest in promising fintech startups. With a keen eye for disruptive technologies and business models, we identify investment opportunities that have the potential for significant growth and positive market impact. Our expertise extends beyond capital investment, as we provide valuable guidance and support to our portfolio companies to help them thrive in the competitive fintech landscape.

Our asset management services encompass the following key areas

Investment Strategy Development

- Collaborative consultation to understand your financial goals and risk tolerance

- Customized investment strategy development based on your objectives and investment horizon

- Asset allocation and diversification recommendations to optimize portfolio performance

- Ongoing evaluation and refinement of investment strategies based on market conditions

Portfolio Construction and Optimization

- Selection of appropriate asset classes, including equities, fixed income, alternative investments, and cash equivalents

- Rigorous research and due diligence to identify high-quality investment opportunities

- Proactive portfolio rebalancing to maintain target asset allocations and manage risk

- Implementation of tax-efficient strategies to enhance after-tax returns

Investment Monitoring and Performance Reporting

- Continuous monitoring of portfolio holdings, market trends, and economic indicators

- Regular performance analysis and reporting, including risk-adjusted metrics and benchmark comparisons

- Proactive identification of investment opportunities and potential risks

- Comprehensive reporting on portfolio performance, asset allocation, and investment activity

Our asset management services encompass the following key areas

Risk Management and Mitigation

- Robust risk management framework to assess and manage investment risks

- Diversification strategies to reduce portfolio volatility and minimize exposure to specific risks

- Ongoing monitoring of market and geopolitical factors that may impact investment performance

- Periodic stress testing and scenario analysis to evaluate portfolio resilience

Wealth Preservation and Estate Planning

- Collaboration with legal and tax professionals to develop comprehensive estate planning strategies

- Structuring investment portfolios to align with long-term wealth preservation goals

- Implementation of wealth transfer and succession planning strategies

- Regular review and adjustment of investment strategies based on changing circumstances

Client Communication and Relationship Management

- Regular portfolio reviews and performance updates

- Timely market insights and investment commentary

- Proactive communication to address client inquiries and concerns

- Thoughtful guidance and education on investment strategies and market trends

In addition to IPOs, funding, and fintech investments, we offer a range of supplementary services to cater to the diverse needs of our clients. These services include debt financing, mergers and acquisitions, and financial advisory services.

Our team of experienced professionals possesses the necessary expertise to provide strategic insights and transactional support for complex financial matters.

Gao Yin Professional Investment Team

Gao Yin have assembled a team of seasoned professionals with extensive backgrounds in the global investment banking industry. Our team members bring a wealth of experience, diverse perspectives, and a proven track record of success to deliver exceptional service and outcomes for our clients. With their deep understanding of financial markets and expertise in investment banking, our team is well-equipped to navigate complex transactions and provide strategic guidance.

Here is an overview of our professional and expert team:

Senior Executives

- Former leaders in prominent global investment banks

- Decades of experience in investment banking and capital markets

- Expertise in mergers and acquisitions, corporate finance, and strategic advisory

- Proven ability to execute complex and transformative transactions for multinational clients

Industry Specialists

- Seasoned professionals with in-depth knowledge of specific sectors such as technology, healthcare, energy, and more

- Comprehensive understanding of industry dynamics, trends, and regulatory environments

- Extensive experience in providing sector-specific investment advice and strategic insights

Capital Markets Experts

- Skilled professionals with a deep understanding of equity and debt capital markets

- Proven track record in facilitating initial public offerings (IPOs), secondary offerings, and debt issuances

- Strong relationships with institutional investors, private equity firms, and key market participants

Financial Analysts

- Detail-oriented analysts with expertise in financial modeling, valuation, and due diligence

- Proficient in conducting comprehensive research and analysis to support investment decisions

- Specialize in providing insightful recommendations and market analysis to drive informed investment strategies

Transaction Specialists

- Seasoned professionals with expertise in structuring and executing complex transactions

- Proficient in deal negotiation, due diligence, and transaction documentation

- Experience in managing diverse stakeholders and ensuring smooth transaction processes

Gao Yin Global Projects Highlights

We have a robust track record of successfully assisting over 300 cases in global funding and asset management. Our expertise and comprehensive range of services have enabled us to support clients in various industries, including technology, healthcare, real estate, energy, and more. Here is a summary of our experience:

Funding Solutions Cases

•We have facilitated numerous funding transactions, including equity and debt financing, venture capital investments, and private placements.

•Our team has helped clients secure capital for business expansion, product development, research initiatives, acquisitions, and working capital needs.

•We have cultivated a strong network of investors, including institutional investors, private equity firms, and angel investors, to connect our clients with suitable funding sources.

Capital Structure Optimization Projects

•Our team has extensive experience in assessing and optimizing clients’ capital structures to enhance financial efficiency and support growth strategies.

•We analyze existing capital structures, debt levels, and equity positions to provide recommendations for optimizing the mix of debt and equity financing.

•We assist clients in refinancing existing debt, negotiating favorable terms, and exploring alternative funding options to improve their overall financial position.

Capital Markets Experts

•Skilled professionals with a deep understanding of equity and debt capital markets

•Proven track record in facilitating initial public offerings (IPOs), secondary offerings, and debt issuances

•Strong relationships with institutional investors, private equity firms, and key market participants

Financial Analysts

•Detail-oriented analysts with expertise in financial modeling, valuation, and due diligence

•Proficient in conducting comprehensive research and analysis to support investment decisions

•Specialize in providing insightful recommendations and market analysis to drive informed investment strategies

Transaction Specialists

•Seasoned professionals with expertise in structuring and executing complex transactions

•Proficient in deal negotiation, due diligence, and transaction documentation

•Experience in managing diverse stakeholders and ensuring smooth transaction processes

Secure Funding for Your Global Ventures Today!

Are you ready to take your business to new heights on a global scale? We specialize in securing funding for ambitious entrepreneurs and companies looking to expand their operations worldwide. With our expertise in global funding, we can help you unlock the financial resources you need to fuel your growth.

Extensive Funding Network

Our well-established network spans across international borders, connecting you with a diverse range of funding sources. Whether you’re seeking venture capital, private equity, government grants, or strategic partnerships, we have the connections to match you with the right investors who understand your global vision.

Cross-Border Financing Expertise

Navigating the complexities of cross-border financing requires specialized knowledge. Our experienced team has a deep understanding of international regulations, compliance requirements, and market dynamics. We’ll guide you through the process, ensuring a smooth funding journey across borders.

Tailored Funding Strategies

We recognize that each business has unique funding needs. Our team will work closely with you to understand your growth objectives and develop customized funding strategies that align with your vision. Whether you need expansion capital, project financing, or working capital solutions, we’ll tailor our approach to meet your specific requirements.

Funding for Various Stages

Whether you’re a startup seeking seed funding or an established company looking for growth capital, we have experience in securing funding at various stages of business development. From early-stage investments to large-scale funding rounds, we’ll assist you in finding the right funding at the right time.

Global Market Insights

As a global funding partner, we stay up-to-date with the latest market trends, investment climates, and emerging opportunities worldwide. We’ll provide you with valuable insights and market intelligence to help you make informed funding decisions and seize growth opportunities in different markets.